PCB TP3 FORM 2022. - Prepare relevant data or report to management.

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Keep all your receipts.

. Restricted to 1000 10. PERNAH BEKERJA SEBELUM INI DALAM TAHUN SEMASA Klik Sini Klik Sini Klik Sini Klik Sini Klik Sini Klik Sini Klik Sini. FRASA KESELAMATAN Mulai 27 Februari 2017 LHDNM akan meningkatkan keselamatan laman sesawang ezHASiL dengan memperkenalkan frasa keselamatan.

I have bad relationship with the boss and the HR has resigned and they are using e-hr platform called HReasily Is there any chances that I can get the NoMajikan in other way other than referring to my old boss and HR. The conversion rate is applicable to Pay With Points participating merchants and cash back redemption. 2022-3-10Note that the amount has been increased from RM5000 back in YA 2020.

But the boss and HR doesnt want to layan me. 2022-3-21Namun ini tidak bermakna bahawa tiada pengecualian cukai lain yang boleh dimanfaatkan oleh pemilik hartanah semasa membuat e-filing mereka tahun ini. W I mean like plsssPetronaz paid gomen.

2022-9-7After filing retain a copy of the forms for your records. You dont need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return. Department of e-Services Application Inland Revenue Board of Malaysia.

Prosedur ini tidak terpakai kepada pembayar cukai yang membuat e-Filing melalui Ejen Cukai. 30 September 2022 ORANG RAMAI DIALU-ALUKAN UNTUK MENYERTAI KONSULTASI AWAM DENGAN HASiL Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai langsung Lembaga Hasil Dalam Negeri Malaysia HASiL mengalu. KKCP Pind 2020 Guidelines.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Ii COVID-19 detection test including purchase of self detection test kit for self spouse child. 2 Bonus Point rewards are capped at 20000 Bonus Points per cardholder per.

FRASA KESELAMATAN Mulai 27 Februari 2017 LHDNM akan meningkatkan keselamatan laman sesawang ezHASiL dengan memperkenalkan frasa keselamatan. All business records expenses receipts for personal reliefs will have to be kept for audit purposes for a period of 7 years. The way they complain macam they are the biggest contributor to huge portion of country incomeAlso I wonder how much they tuntut semula in e filling.

E - Janji Temu. If youre a very busy person or if this is your first time doing this you might just forget to fill up that LHDN form on timePlease note that the deadlines for tax filing are 30th April 2022 and 15th May 2022 for manual filing and e-Filing respectively. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

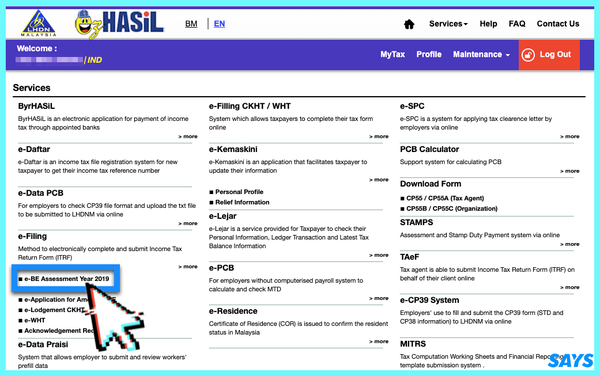

The Inland Revenue Board LHDN has also done away with a sub-category of this tax relief that previously allowed individuals to claim RM1500 for each parent RM3000 for mother and father if they did not make a claim for medical treatment for their parents. Im trying to look for NoMajikan from my previous company. 2021-12-17Now that youve registered as a taxpayer youll need to register for e-Filing on the ezHASiL platform.

I wonder how much they paid for income tax. Tarikh akhir pengemukaan BNCP ialah 30 April untuk individu yang tiada punca pendapatan perniagaan - Borang BEe-BE dan 30 Jun untuk individu yang ada punca pendapatan perniagaan - Borang Be-B setiap tahun. 2022-10-19- TIADA Penerbitan Pusat Penyelidikan Klinikal CRC Polisi pelawat melawat ini diperkenalkan adalah untuk memberi makluman serta pengetahuan mengenai peraturan peraturan yang ditetapkan di dalam kawasan Hospital Sultanah Nur Zahirah.

If youre registering for e-Filing for the first time youll need a one-time login 16-digit PIN provided by LHDN. - Any other task as assigned by superior. I cannot tahan see some people rant I pay income tax bla bla bla but I go nothing from budgetWow.

Dalam usaha meningkatkan ekonomi yang terjejas semasa pandemik COVID-19 kerajaan mewartakan Potongan Khas Cukai Pendapatan Untuk Pengurangan Sewa Kepada Penyewa Selain Daripada. You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. There is no No majikan stated in my.

Return Form RF Filing Programme. PREVIOUSLY EMPLOYED IN CURRENT YEAR. KKCP Pind 2019.

PCB TP1 FORM 2022. If you are part of a partnership business your partnership income will be stated on Form CP30 which is issued by the precedent partner to all partners. Coronavirus Disease 2019 Covid-19 Restricted to 1000 9 i Complete medical examination for self spouse child as defined by the Malaysian Medical Council MMC.

Income Tax Filing for Partnerships. Pendapatan berkanun penggajian Maklumat untuk bahagian ini boleh didapati daripada Bahagian B dalam borang EA anda. 2022-10-13Pembayar cukai boleh mengemukakan memfailkan Borang Nyata Cukai Pendapatan BNCP secara online melalui e-Filing atau secara manual.

2022-2-15Senarai Pelepasan Cukai Bagi Tahun Taksiran 2021 LHDN e-Filing 2022 KEMASKINI 15 FEBRUARI 2022. Prosedur ini tidak terpakai kepada pembayar cukai yang membuat e-Filing melalui Ejen Cukai. 2022-2-1The accounting treatment on the effects of changes in foreign exchange rates has been outlined in MFRS 121 which is equivalent to IAS 21The Malaysian Inland Revenue Board LHDN has issued a revised Guidelines on tax treatment related to the implementation of MFRS 121 on 16 May 2019 and subsequently issued a Public Ruling PR 122019 on the tax.

From the period of 112019 until 31122021 disposal in the sixth year after the date of acquisition of the chargeable asset is 5. - Manage records and documentation of all activities on site. DanCoronavirus Disease 2019 Covid-19Terhad 1000 9 i Pemeriksaan perubatan penuh.

2022-4-14This was highlighted in the revised Guidelines for Application Of Approval Under Subsection 446 Of The Income Tax Act 1967 dated 15 May 2019. For the period of 112022 and thereafter disposal in the sixth year after the date of acquisition of the chargeable asset is changed back to nil. KKCP Pind 2019 Borang PCB TP1 2022 Borang PCB TP3 2022 Garis Panduan KKCP Pind 2020 PENGIRAAN PCB TAHUN.

You can get it from the nearest LHDN branch office or apply online via the LHDN Customer Feedback website. 1 Best bonus points conversion of 400 Bonus Points RM1 offered by CIMB is in comparison against other consumer banks in Malaysia published as of 30 September 2022. According to the document organisations are requested to issue official tax exemption receipts only for donors who have provided all required particulars.

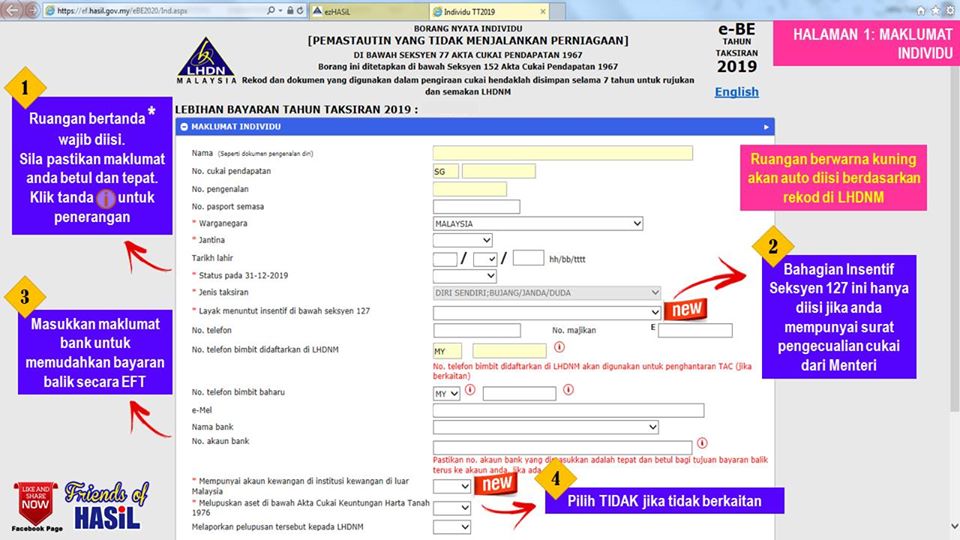

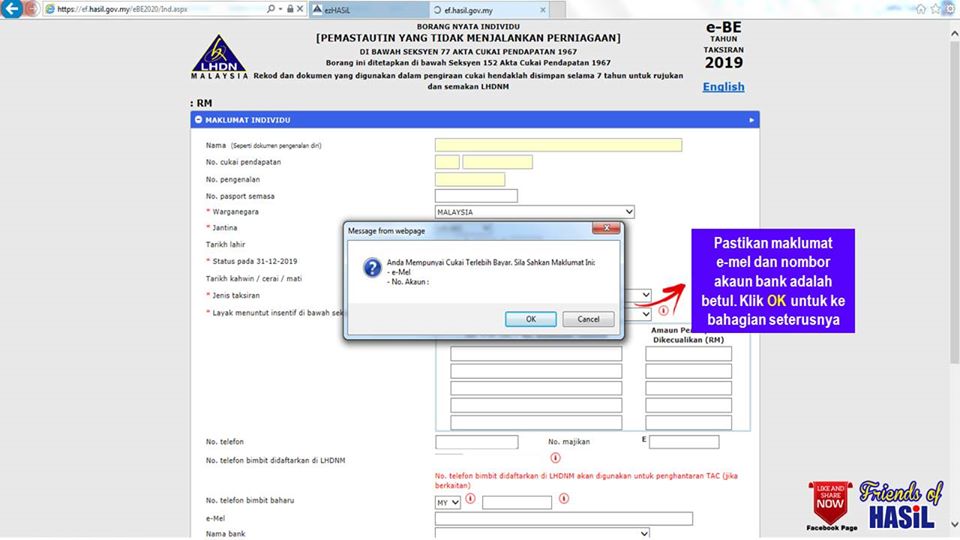

2022-3-7Take note of the LHDN e-filling 2021 deadline. 2021-2-28Panduan lengkap untuk cara-cara mengisi e-filing lhdn borang BE atau borang nyata cukai bagi individu yang bekerja dengan majikan. 2018-12-1- Ensure proper documentation filing and record for SPAN JTK Local Authority JBA State government CIDB UPEN TNB consultant OSH ST Sustainability submissionplandata.

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Cara Isi E Filing Lhdn Untuk 2020 2021 Panduan Lengkap

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

E Filing Lhdn Apps On Google Play

E Filing 2022 Tarikh Buka Login Mytax Lhdn Taksiran 2021

Cara Buat E Filing Cukai Pendapatan 2021 Untuk First Timer Mulai 1 Mac

Tarikh Akhir Hantar Borang Cukai Efilling 2022 Tahun Taksiran 2021

Personal Income Tax E Filing For First Timers In Malaysia

Income Tax Relief For Lhdn E Filing 2022 Ya 2021 Joy N Escapade

.jpg)

Income Tax Returns For 2019 Can Be Submitted Via E Filing Starting March 1 Malay Mail

How To Generate E Form Cp8d Actpay Payroll

Isi Cukai Pendapatan Melalui E Filing Lhdn Youtube

Senarai Pelepasan Cukai Individu Lhdn 2019 E Filing 2020

Cara Isi E Filing Lhdn Untuk 2020 2021 Panduan Lengkap

How To File Income Tax For The First Time

Cara Buat E Filing Cukai Pendapatan 2021 Untuk First Timer Mulai 1 Mac

St Partners Plt Chartered Accountants Malaysia Lhdn Operating Hours For Irbm E Filing Counters During Ramadan 2019 1440h From 6 May To 4 June 2019 Facebook